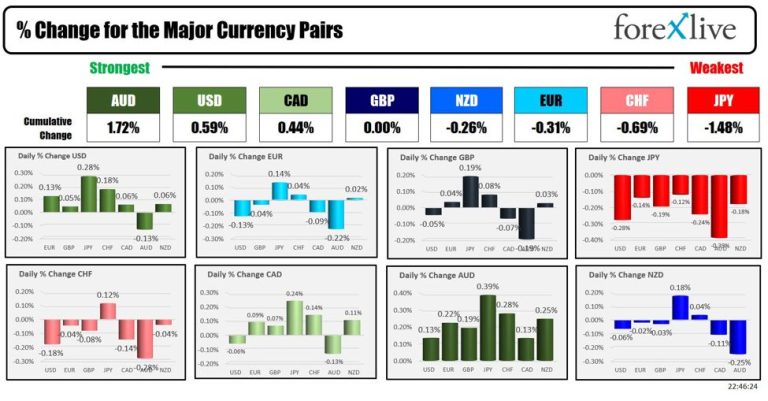

In the early hours of the morning, the Australian dollar was the strongest among major currencies in the Asia-Pacific region, while the Japanese yen was the weakest.

Essentially, Australia's CPI came in slightly higher at 3.5% versus the expected 3.4%, but the good news is that it has been trending down since peaking at 4.0% in May. The low point of the high cycle after the sharp rise was 3.4% in December through to February.

AUDUSD rose 0.13%, which isn't a huge amount, but it rose 0.39% against the JPY, which got its impetus from some ambiguous comments from Bank of Japan Governor Himino.

Himino stressed that instability in financial and capital markets continues, and stressed the need for the Bank of Japan to monitor these developments with the utmost vigilance. He said the Bank will carefully assess how these market changes both at home and abroad will affect economic activity, prices, associated risks, and confidence in the economic outlook.

He added that “the Bank of Japan is prepared to adjust monetary policy (referring to interest rate hikes) once it is convinced that its economic and price outlooks will be realized,” but stressed the importance of properly managing monetary policy in order to achieve the 2 percent inflation target in a sustainable and stable manner while communicating closely with market participants and other stakeholders.

He noted the need to closely monitor recent market fluctuations, such as falling stock prices and a stronger yen, and acknowledged the importance of refining the BOJ's approach to estimating the neutral interest rate as a useful reference, but cautioned that estimating the neutral interest rate does not automatically indicate the correct policy direction.

Looking ahead to fiscal 2025 and 2026, Himino expects inflation to be in line with the price stability target and economic growth to be in a balanced state slightly above cruising speed. Finally, Himino also acknowledges that the recent appreciation of the yen may ease import costs and profit pressures for small and medium-sized enterprises, but may also reduce yen-denominated profits for export industries and Japanese multinationals.

The market interpreted the ambiguous comments as more dovish, sending USDJPY and other cross currencies higher (Yen weaker).

For USDJPY, 50% of the upside from the 2023 low would be at 144.58. Above this, traders would have their eye on the 100-hour moving average (MA) at 144.899 (and move lower). Recall that yesterday's MA stalled the upside.

As for EURUSD, today the price has reversed some of yesterday's gains and is heading towards the upside of the 100-hour MA at 1.11549. Similar to USDJPY, yesterday the price was stuck at the 100-hour MA before reversing to the upside.

Japan's Nikkei Stock Average is trading down -0.22%.

Spot gold is trading at $2,514, down -$10.64 (-0.43%) after closing at its highest price yesterday.

Bitcoin dipped below $60,000 again after failing to rise above the 100/200-day moving averages near $63,550 last week and on Monday. Prices bottomed out at $58,900 on Tuesday before rebounding modestly.